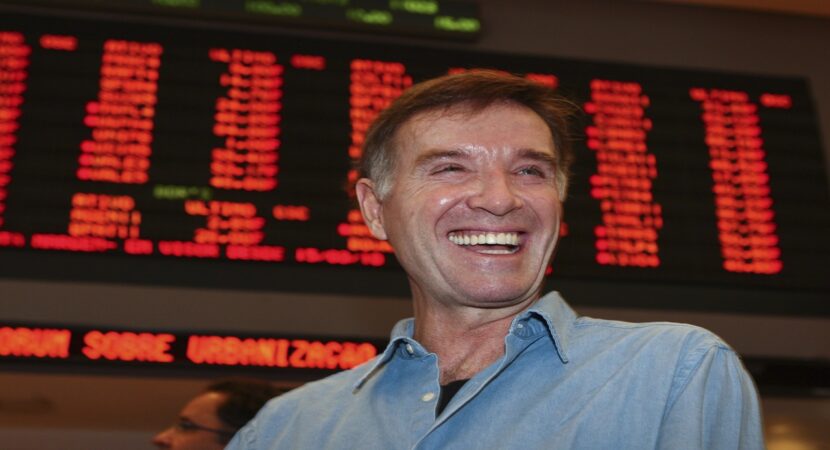

Shares of MMX Mineração e Metálicos return to investors' radar and soar on the stock exchange with the partnership between Eike and China

After the big news that Eike signs a partnership with China and gains 'infinite' capital to put oil and gas, mining, renewable energy and infrastructure projects into practice in Brazil, the shares of MMX, the company undergoing judicial recovery of the former billionaire, skyrocket on the stock exchange.

Read also

- Eike Batista tries to buy back Porto do Açu with the help of the Chinese company China Development Integration (CDIL)

- According to journalists, extraction of ore in the Amazon started by Eike Batista resulted in the death of workers and misery

- Petrobras invests in Northern Brazil and buys stake in 6 oil exploration blocks from the oil company BP

- Leader in South America in the production and sale of meat, invites candidates with no experience for trainee positions in SP

MMX Mineração e Metálicos, an EBX group company that operates in iron ore mining, have returned to investors’ radar since mid-March, after jumping more than 500% in 2020.

In 2021, the assets accumulate gains of 63,47% taking into account the closing until the last Tuesday and, since the closing of March 18 until the last session, the accumulated gains were 84%.

MMX Mineração e Metálicos, believes that the oscillations may be related to the announcement of the partnership between Eike and the company China Development Integration Limited (CDIL)

MMX says it is not aware of other relevant acts that could justify fluctuations in MMX shares on the stock exchange, other than the fact that they may be related to the facts disclosed in March of this year, where the company “informed the market of the negotiation and the possible investment by China Development Integration Limited (CDIL) in the company and its subsidiaries, which would enable the payment of creditors and the resumption of its operations”.

MMX informed that it was negotiating with CDIL, a company based in Hong Kong, China, which develops large infrastructure, engineering and mining projects in several countries, which showed interest in investing in the development of the company's assets.

“The negotiation is aimed at exploring mines owned by the company, in particular the Bom Sucesso Mine, owned by MMX Sudeste Mineração. The negotiation is carried out within the scope of the current administration's effort to promote economic restructuring and organize in a viable way the payment of all creditors of MMX and its subsidiaries", he said in the statement, noting that there was no contract or binding document signed between the parts.

Abradin alleges that the material fact disclosed by Eike's company is "a lie and a fantasy"

Later, on the 25th, Eike's company stated that MMX, its subsidiaries MMX Sudeste Mineração, MMX Corumbá Mineração, Rubicon Capital Partners Desenvolvimento de Negócios LTDA and China Development Integration Limited signed a term sheet, a kind of letter of intent signed between the companies involved in the business, stipulating terms and conditions for the investor to make a contribution.

CDIL's investment in MMX or its subsidiaries provided for in Term Sheet has among its precedent conditions the reform of the decision of the Judicial Reorganization court issued on August 21, 2019, which decreed the bankruptcy of MMX and MMX Corumbá, the presentation of a new Judicial Reorganization plan for MMX and MMX Corumbá, whose terms and clauses are accepted by the investor, as well as their approval by the respective creditors, and the Plan must provide for the destination of the investment, in addition to the execution of an Addendum to the Judicial Recovery Plan of MMX Sudeste.

Abradin – Associação Brasileira de Investidores, criticized the statement claiming that the material fact disclosed by Eike's company is “a liar and a fantasy” and that it has the “power of manipulating the capital market, harming investors”.

What caught Abradin's attention was the intention to link the contribution of US$ 50 million to a turnaround in the MMX Corumbá bankruptcy process, to be judged shortly at the Rio de Janeiro Court of Justice, and to the approval of a new judicial recovery plan for the company. "There is evidence that this investment is being used as a way to manipulate the market and the courts, in order to reverse the company's bankruptcy," Aurélio Valporto, president of Abradin, told Veja.

Air Force F-16 fighters…

True friend, what they shot down were…

Air Force F-16 fighters…

I would like to know what planet you live on…

Air Force F-16 fighters…

Everything is fine, 100-year secrecy,…

Air Force F-16 fighters…

Well... It's flying scrap... Typical...

Air Force F-16 fighters…

Which genocide are you talking about? Than…

Good evening, I'm a bricklayer, how do I do…

In China there is a dictatorship that…

I'm an electrician and my wife has a degree...

Yes, I would buy it. The price expectation is…

This train was a 4,5…

That's it, Brazil, forward and...

I'm interested in going to work there, if...

I didn't know about this news