Aluminum sales volume reached more than 1,5 tons in 2021 and made history on the national scene

São Paulo, May 10, 2022 – The aluminum sector is hotter than ever, according to data from the Brazilian Aluminum Association (ABAL). After all, more than 1.583,9 thousand tons were sold in 2021, the highest amount since the first analysis of this market, carried out in 1972. This represents an increase of 10,9% compared to 2020 and reinforces investment expectations. The CBA is concrete proof of these numbers.

You know what's more interesting? The power of national production. For, of this total volume of aluminum, approximately 1.393,4 thousand tons, that is, 88%, were manufactured in the national territory, which represents an increase of 10,6% in relation to previous years. Furthermore, imports increased by 12,7%. This result reaffirms the potential of national aluminum, which goes beyond the barriers imposed by the crisis and manages to grow exponentially and in a sustainable manner.

Consumption of sheets was the main protagonist of this feat, with sales reaching the incredible mark of 800,6 thousand tons, which represents an increase of 16,2% in relation to the previous year. This is the result of increased activity in the packaging segment, which alone accounted for more than 40% of aluminum sales volume.

With the exception of aluminum powder and cables, all household products saw an increase in sales volume.

The sales volume of processed aluminum products for domestic use is really impressive. See the numbers:

- Extruded: 245,8 thousand tons in 2021, 17,2% more than the previous year;

- Cast: 157,8 thousand tons, 16,7% more than in the previous year;

- Laminates: 889,1 thousand tons, 14,9% more than in the previous year;

- Destructive: 42,9 thousand tons, 16,3% more than in the previous year;

- Other: 41,9 thousand tons, 25,1% more than in the previous year.

Cables and powder showed a drop in sales volume, but not very significant in the general context. Check out:

- Cables: 180,8 thousand tons, 15,1% less than in the previous year;

- Dust: 25,6 thousand tons, 5,2% less than in the previous year;

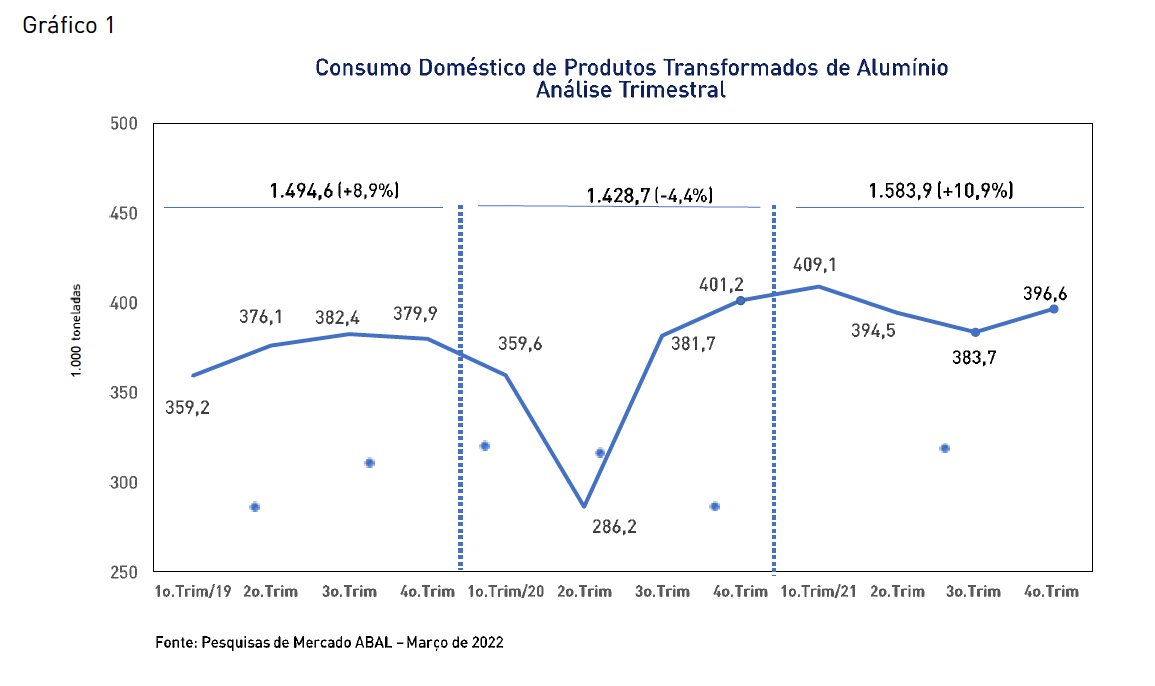

The quarterly analysis of domestic consumption of transformed aluminum products, carried out by ABAL, brings very interesting data, which points to an excellent market recovery from the end of 2020 to the beginning of 2021. See Graph 1 below.

Note that the pandemic brought a huge drop in sales volume and investment losses, especially in the second quarter of 2020, which marked the beginning of this global catastrophe. However, the sector achieves a significant and growing recovery from the third quarter of 2020.

STransport segment leads the rise in percentage, but packaging still has the highest sales volume

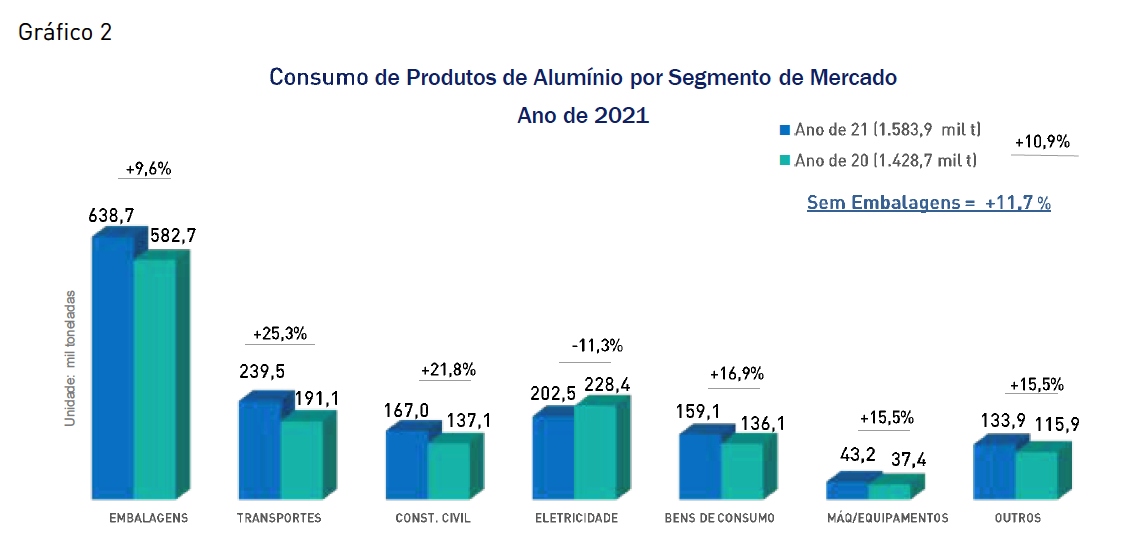

Several segments use aluminum and had an increase in sales volume taking into account our national production. However, the transport sector showed an increase of more than 25% compared to 2020. Even so, the highlight goes to the packaging sector which reached the impressive mark of 638,7 thousand tons, a value 9,6% higher than in the previous year. Check the values in Graph 2.

With regard to the performance of the main aluminum consumer segments, as shown in Graph 2, the majority showed double-digit growth. The exception was Electricity, which recorded a drop of 11,3%, reflecting the reduction in metal consumption in energy transmission line projects in the country.

Note that the electricity sector was an exception and had a drop of more than 11% in sales volume, compared to 2020. This reflects the replacement of aluminum by other products for structuring transmission lines in Brazil.

The forecast for 2022 is to expand aluminum production capacity and investments to meet new demands

ABAL experts are optimistic and point to an even greater increase in sales volume for 2022. What is expected is an increase of 4,9%, which means a total of 1.662 thousand tons, breaking the record reached in 2021.

For this, the sector must inject approximately R$ 30 billion until 2025 to increase the infrastructure and modernization, in addition to sustainability issues. In this way, the sector will meet the new sales demand and also generate greater autonomy in energy generation and diversify energy sources, which contributes to the environmental front.

After all, who is ABAL?

Created in 1970, the Brazilian Aluminum Association (ABAL) is a body that gives voice to all Brazilian segments associated with aluminum production, from bauxite suppliers to recyclers and transformed aluminum producers. In addition, ABAL prepares reports containing statistics that are of interest to the segment and the country's economic growth, helping to understand the needs of the market, supply and demand, and greater updating of professionals.

Air Force F-16 fighters…

True friend, what they shot down were…

Air Force F-16 fighters…

I would like to know what planet you live on…

Air Force F-16 fighters…

Everything is fine, 100-year secrecy,…

Air Force F-16 fighters…

Well... It's flying scrap... Typical...

Air Force F-16 fighters…

Which genocide are you talking about? Than…

I want to know the rest about him, how many cameras…

I want information about work, farming and transport

They didn’t even build this line and the route…

I am a Maintenance Boiler and Industrial Plumber

I am ex military

What nonsense. Deceive muggles. The government comes…

If it's true, I'll buy two a lot...

Excellent article! Now where are the quotes…