Petrobras today has a high debt profile – US$ 86 billion – so, in addition to reducing this debt, the company needs to raise funds to invest in exploration and production.

In parallel to President Jair Bolsonaro's visit to the Emirates, Roberto Ardenghy, director of Institutional Relations at Petrobras, participated in a business seminar in Brazil, this Sunday, 27th, in Abu Dhabi, where he informed that the state-owned oil company is looking for clients for its refineries and partners for bids in the Gulf countries. The oil market reheats and 400 jobs are expected to be created.

"We came to show our assets for sale and partnership opportunities," said Ardenghy to ANBA. According to Ardenghy, the state-owned company is looking for partners to join consortia with the purpose of competing in the next tenders for exploration and production of oil and gas that will take place in Brazil.

“There is great interest in refining here,” he said. According to him, Petrobras accounts for 98% of refining in Brazil and wants to sell half of its assets in the area. They are refineries in Rio Grande do Sul, Paraná, Minas Gerais, Bahia, Rio Grande do Norte, Ceará and Amazonas.

According to the executive there is interest from investors in the Gulf region. “There is interest and I came [here] to reinforce that. They have a lot of experience in the refining area”, and he added that Brazil is attractive, as it is the fifth largest refining market in the world.

The executive states that Petrobras will have two investment options, one will take place on November 06th, being "the biggest round" of bids for the surplus of the onerous assignment of pre-salt areas, when four "giant" fields will be offered, and the another opportunity will occur on the following day, the 07th, which will be the 6th pre-salt bidding round in the production sharing model, organized by the ANP.

In the first case, Ardenghy says that 14 companies are already qualified to participate and, in the last one, there are 17 qualified companies. He confirmed that there are conversations with companies in the Gulf about forming consortia, and added that the company wants resources to concentrate on what he called the “largest mineral province in the world” currently, which is the pre-salt layer.

“There are wells [in the pre-salt] that produce 58 barrels a day, only in the Middle East do they produce more. The average production from the wells is 17 barrels a day,” he said.

Investors from the Emirates were invited during the seminar to participate in the pre-salt auction on November 06, by President Jair Bolsonaro and the Minister of Civil Affairs, Onyx Lorenzoni. “In the next few days we will have one of the largest pre-salt auctions in our country and we invite everyone to participate”, declared the president. Lorenzoni characterized the tender as “the largest Western oil and gas auction”.

From the region, Qatar Petroleum has won four oil exploration and production tenders held in Brazil, in partnership with other companies.

The executive also said that Petrobras currently has a high debt profile – of US$ 86 billion – so, in addition to reducing this debt, the company needs to raise funds to invest in exploration and production. To this end, it is promoting “a strong cost-cutting process” and “divestments”, that is, the sale of assets.

So far this year, the company raised $13,3 billion in “divestments” and expects to reach $15 billion by the end of 2019.

Air Force F-16 fighters…

True friend, what they shot down were…

Air Force F-16 fighters…

I would like to know what planet you live on…

Air Force F-16 fighters…

Everything is fine, 100-year secrecy,…

Air Force F-16 fighters…

Well... It's flying scrap... Typical...

Air Force F-16 fighters…

Which genocide are you talking about? Than…

Where changes were made, the changes will come…

Fascinating! However, it will take a long time for us to…

I think so much information is unnecessary for a…

The technology used in…

Don't take the train because it's practically…

Spectacular, especially the price. I've seen others...

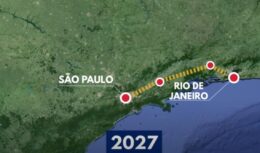

Very poor project with the final station…

I work in the construction area, bricklayer, painter…