Federal Government zeroes import tax on six foodstuffs and ethanol. On the food list are roasted coffee, margarine, cheese, macaroni, sugar and soybean oil; forecast is a reduction of up to R$ 0,20 in the price of gasoline

On the last 23rd, the Federal Government rreduced to zero the import tax on six foodstuffs in the basic basket and on ethanol, which promises to reduce gasoline prices by up to R$ 0,20. The measure was approved at an extraordinary meeting of the Executive Management Committee (Gecex) of the Foreign Trade Chamber (Camex), a body linked to the Ministry of Economy, and seeks to reduce the impacts of inflation.

On the list of foods with zero import taxes by the Government are roasted coffee, margarine, cheese, macaroni, sugar and soy oil. According to the Ministry of Economy, these products had high prices above the country's inflation average. Until then, the Import Tax was 28% for cheese, 14,4% for sugar, 14,4% for macaroni, 10,8% for margarine, 9% for coffee, 9% for oil of soy and 18% for ethanol.

“We are also very concerned about the impact of inflation on the poorest population, on the general population. We know how much this can erode everyone's purchasing power", highlighted the executive secretary of the Ministry of Economy, Marcelo Guaranys.

Ethanol tax cut will impact gasoline price

O cut in the ethanol tax will impact the price of gasoline. This is because a percentage of 25% of ethanol is added to gasoline sold at gas stations across the country. “With the reduction to zero of the import tariff [on ethanol], which today is 18%, we have an estimate that this could lead to a reduction in the price of gasoline,” said the Secretary of Foreign Trade at the Ministry of Economy, Lucas Ferraz.

The tax will be zeroed as of this Wednesday (23/03), when the measure is published in the Official Gazette of the Union, and is valid until the end of the year.

Reduction by another 10% of the Import Tax on capital and IT goods

At the same meeting, Camex approved a further 10% reduction in the Import Tax on capital goods, which are machines and equipment used in industry, and on IT and telecommunications goods, such as computers, tablets and cell phones.

This was the second cut in the import tariff for capital goods and telecommunications. In March of last year, the Federal Government had also reduced this rate by 10%. With that, the tax cut reaches 20%.

This tax burden reduction, as well as others, is one of the structuring measures that have been adopted by the Ministry of Economy to increase the country's competitiveness, stimulating the generation of employment and income.

With the decision, a product that had an import tax rate of 14% before the reduction made in 2021, will now have, with the second reduction, a rate of 11,2%.

According to the Ministry of Economy, the measure seeks to increase the productivity and competitiveness of the Brazilian economy, by reducing the costs involved in importing strategic products.

The Federal Government's estimate is that the reductions in import tax will cause the Union to stop collecting R$ 1 billion this year. As this is an extrafiscal tax, of a regulatory nature, the presentation of compensation measures, as authorized by the Fiscal Responsibility Law, is waived.

IPI reduction

A reduction in the Import Tax was adopted by the Federal Government after giving incentive to the national industry. In early March, President Jair Bolsonaro edited a decree that reduces the Tax on Industrialized Products (IPI) by 25% for most products. Among the various products covered by the measure are white goods such as refrigerators, freezers, stoves, washing machines and cars.

For some types of automobiles, in accordance with current incentive policies, the rates will be reduced by 18,5%. The IPI is levied on industrialized products, national and foreign.

In this way, the Federal Government works with incentive measures for the recovery of the economy and expansion of productivity, contributing to the dynamization of production, generation of jobs and income.

Air Force F-16 fighters…

True friend, what they shot down were…

Air Force F-16 fighters…

I would like to know what planet you live on…

Air Force F-16 fighters…

Everything is fine, 100-year secrecy,…

Air Force F-16 fighters…

Well... It's flying scrap... Typical...

Air Force F-16 fighters…

Which genocide are you talking about? Than…

Medical radiology technologist with 10 years…

For this price 43.000 I already want to book…

I am a technician in the area of machining, boring machines…

I am interested! I'm a nurse

They should be ashamed of any need to…

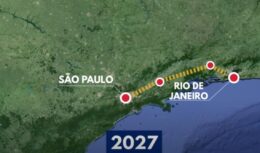

With so many stopping stations…

I'm a bricklayer

Great