Last Friday (27th), Eletrobras' share offerings were launched. In this way, Brazilians could purchase shares in the institution through the FGTS application (Fundo de Garantia do Tempo de Serviço) using the balance they have at the institution.

Brazilians with an active or inactive account on the FGTS can now launch Privatization Mutual Funds (FMPs) with the balance available to buy parts of Eletrobras shares, which had been raising debates for years about the possibility of privatization to leverage the economy and increase market competition.

As announced by the Federal Savings Bank of Brazil, Share reservations will open for online requests as of June 03rd and the deadline for this is expected to be June 08th. It is worth mentioning that the reservation can be made by any institution as long as it is authorized by the Central Bank of Brazil. It is known, so far, that the worker has the possibility of using at least 50% of his balance for the reserve and that the minimum amount that must be invested for the purchase of a part of the state-owned company is around R$ 200 .

Operational Manual for Application of FGTS in Mutual Funds for Privatization at Eletrobras

Through the folder named “FGTS Manuals and Operational Booklets”, citizens are able to read and have access to all the material on the use of the Severance Indemnity Fund for the purchase of shares in the state-owned Eletrobras.

The final choice to purchase shares can be made through any operator that is authorized to operate with FMP-FGTS. However, before using the account of other banks and brokerages for the purchase, it is important that the citizen enters the FGTS app and allows the purchase to be made by other means. Therefore, authorize another institution to view your linked balance to make the purchase of the reservations that were indicated.

Workers also have the alternative of going to Caixa branches to check the amount available and then invest.

Possible doubts on the subject can be addressed through the number 4004-0104, for capitals and metropolitan regions and by 0800 104 0104, in other regions.

Company shares and history

Since 2021, privatization was already in the plans of Jair Bolsonaro's government. The state-owned company is currently one of the largest energy producers in all of Brazil. According to what was announced by the President of the Republic, privatization would have a positive effect on the economy by increase competition and bring more money into public coffers.

Centrais Elétricas Brasileiras SA (Eletrobras) was created in 1954 during the government of Getúlio Vargas, who developed several other state-owned companies, including Petrobras. Its creation made Brazil begin to develop an urban population, therefore, to carry out the rural exodus to work in the big cities.

The project for the creation of Eletrobras took seven years to be approved by the National Congress and, during the year 1990, the state-owned company would have been harmed after carrying out reforms by the government, which were intended to carry out privatization. Now, the most conservative groups are in favor of privatization, but the opposition of the Bolsonaro government has been against such an act.

Air Force F-16 fighters…

True friend, what they shot down were…

Air Force F-16 fighters…

I would like to know what planet you live on…

Air Force F-16 fighters…

Everything is fine, 100-year secrecy,…

Air Force F-16 fighters…

Well... It's flying scrap... Typical...

Air Force F-16 fighters…

Which genocide are you talking about? Than…

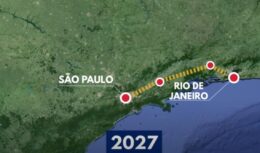

Fascinante! Porém, levará muito tempo para termos…

I think so much information is unnecessary for a…

The technology used in…

Don't take the train because it's practically…

Spectacular, especially the price. I've seen others...

Very poor project with the final station…

I work in the construction area, bricklayer, painter…

Work in the construction sector