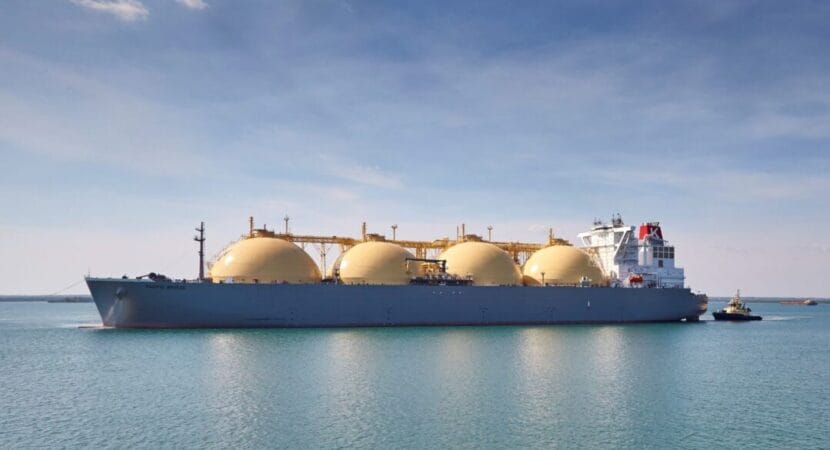

Gas market | LNG freight rates are expected to decrease with fleet growth and lower global prices.

Wood Mackenzie projects that the LNG prices will fall in 2024, due to high levels of storage and the mild winter in the Northern Hemisphere. This will result in relatively low global prices due to subdued global demand and limited LNG supply growth.

Weak Asian demand for liquefied natural gas (LNG) will contribute to maintaining competition for LNG at low levels, according to Wood Mackenzie's Vice President of Gas Research, Massimo Di Odoardo.

Global LNG demand and global prices

The growth of Global demand of liquefied natural gas (LNG) will remain limited, the consultancy projects.

European demand fell 7% in 2023, influenced in part by mild winter, and the expectation for 2024 is that, at best, it will remain stable

In Asia, there is a more positive view: expected growth is 5% compared to 2023, but demand in 2024 will still be almost 3 million tons lower than 2021 levels.

Wood Mackenzie also expects global long-term hiring to cool in 2024, compared to the huge number of deals signed between 2021 and 2023.

The scenario designed by the consultancy could mean the beginning of a movement of price reduction global liquefied natural gas (LNG) markets after being heavily pressured between 2021 and 2023.

Expectations for the global LNG market

In 2023 the International Energy Agencywill ease tensions over liquefied natural gas (LNG) prices between 2025/2026. A vision similar to that of S&P Global.

On the demand side, the IEA estimates that, after their peak between 2011 and 2021, global gas markets will enter a new and more uncertain period – and one that will likely be characterized by slower growth and greater volatility and could lead to a peak in demand at the end of this decade.

Liquefied natural gas (LNG) freight rates are also expected to slow down with the prospect of fleet growth. Wood Mackenzie, in fact, sees the risk of excess supply in the maritime transport sector.

'There will be limited growth in organic liquefied natural gas (LNG) supply and most US LNG is expected to be routed to Europe rather than Asia, limiting demand for shipping and putting pressure on rates of freight', analyzes Di Odoardo.

Source: EPBR