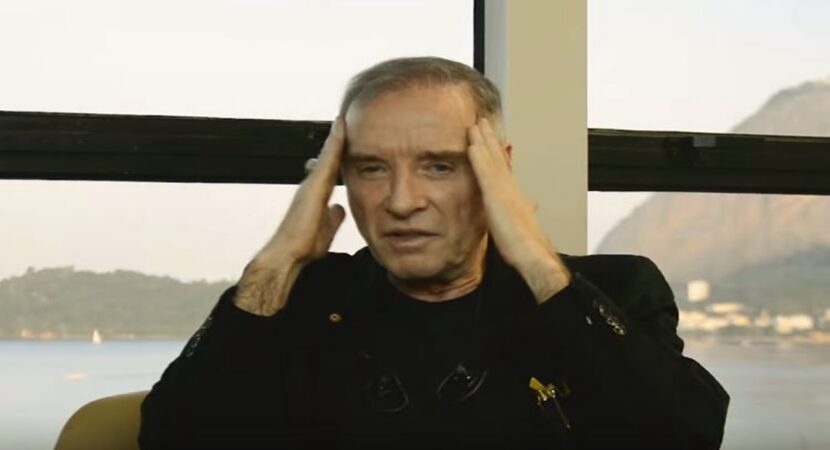

Shares of MMX Mineração e Metálico – company undergoing judicial recovery of former billionaire Eike Batista – plummet on the stock exchange

Former billionaire Eike Batista sees the MMX shares, currently undergoing judicial reorganization, melt on the stock exchange after the mining company was summoned by the Justice of Rio de Janeiro to pay R$ 3,4 billion in tax debts. The values were updated until November 2020.

Read also

- With 'infinite' capital from China, Eike looks to Porto do Açu for the construction of a solar plant

- Eike and China announce partnership and shares of MMX – company undergoing judicial recovery of the former billionaire, soar on the stock exchange

- According to journalists, extraction of ore in the Amazon started by Eike Batista resulted in the death of workers and misery

- Tragedy on Petrobras' P-51 platform! Worker takes his own life on board in the Campos Basin

The warrant was received by the company last Friday (16) and was issued by the 5th Tax Enforcement Court. The lawsuit is filed by the Federal Revenue Service and refers to non-payment of Income Tax and Social Contribution on Net Income (CSLL) on the sale of 30% of the Minas-Rio and Amapá projects in 2007.

“The Tax Execution originates from alleged obligations to pay Corporate Income Tax (“IRPJ”) and Social Contribution on Net Income (“CSLL”) arising from or related to the disposal of equity interests in Centennial Asset Mining Fund LLC ( “CAMF”, one of the controlling shareholders of MMX) in the capital (i) of Centennial Asset Participações Amapá S/A to Cleveland-Cliffs, Inc and (ii) of Centennial Asset Participações Minas-Rio S/A to Anglo American Participações e Minerações S/A (“Anglo”), both occurred in 2007, which resulted in the sale of 30% of the Minas-Rio and Amapá Projects”, he informed.

MMX “studies the best strategy to preserve the interests of its shareholders and creditors”

According to the material fact released on Monday (19), MMX “is studying the best strategy and the most appropriate measures to preserve the interests of its shareholders and creditors, given the impact of the tax foreclosure on its business and on its new judicial recovery plan” said about the events of former billionaire Eike Batista.

In October 2020 (most recent data), Eike owned 18,95% of the mining company, and Centennial Asset Mining Fund, a vehicle that brings together several investors, 21,04%.

Eike signs a partnership with China and gains 'infinite' capital to put oil and gas, mining, renewable energy and infrastructure projects into practice in Brazil

After seeing his empire go downhill, former billionaire Eike Batista has been busy nurturing a list of at least 11 projects that he calls 'unicorns', which include a gas pipeline linking Brazil to Paraguay, new gold mines, renewable energy and nanotechnology.

The new business between the Chinese and the former billionaire will be as follows: Eike contributes his pipeline of projects (including assets and optioned assets) and CDIL provides the seemingly infinite capital, in addition to carrying with it several Chinese banks and state-owned companies that will be responsible for providing machinery, equipment and services and, when dealing with agricultural or metal commodities, will guarantee the purchase of production in the form of offtake agreements.

Eike "is one of the greatest developers of natural resources in history," CDIL chairman Andy Lai told the Brazil Journal in a Zoom video call from Hong Kong. “He developed one of the largest mines in the world [the Minas-Rio project, which today belongs to Anglo American], he knows the data on the large reserves still unexplored and he set up the largest infrastructure projects in Brazil. For us, leveraging their knowledge and experience is wise.”

For the Chinese CDIL, its joint investments with Eike will reach tens of billions of reais, from mining to infrastructure. A mining company MMX it is the first test of the new partnership, and it announced last week that the CDIL is negotiating the company's debts with creditors and intends to take it out of judicial recovery.

This is the first time I read a…

I'm blocking your website on Google because...

Wonderful! I want it👏👏👏👏

Since the beginning of the presidential campaign, when…

That depends, if you have the money to…

This is Bozo FDP's thing

The country that spends on aircraft carriers…

Paying 119K to drive in an Altinho car,…