Aker will receive $700 million in cash and Schlumberger stock as part of the deal, and expects to post $1 billion in profit at closing!

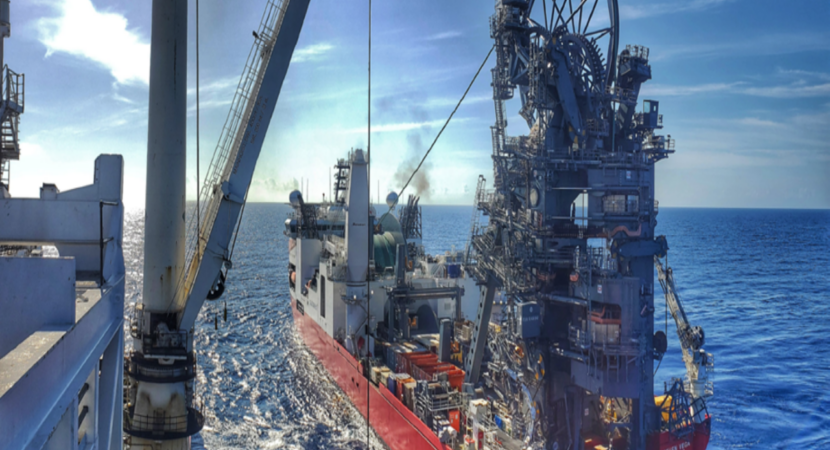

US engineering company Schlumberger and Norway's Aker Solutions, today announced an agreement to form a joint ventureby merging its subsea oil and gas construction businesses and bringing in a third rival, Oslo-listed Subsea 7, as a partner, the oil companies said.

The deal will bring together a portfolio of innovative technologies such as subsea gas compression, all-electric subsea production systems and other electrification capabilities that help customers achieve their decarbonization targets.

“As investment in the offshore market – particularly in deepwater – continues to increase, our customers will benefit from enhanced services that leverage digital and technological innovation to drive better performance from subsea assets, increasing energy efficiency and reducing emissions. of CO2,” said Olivier Le Peuch, CEO of Schlumberger. “We look forward to collaborating with Aker Solutions and our subsea integration partner Subsea 7 on this new venture.”

Aker Solutions will receive $700 million in cash and Schlumberger stock as part of the deal, and expects to post a profit of around $1 billion at the time of closing, the Norwegian company said.

The combined business Oil multinationals will have approximately 9.000 employees worldwide!

The deal will leave Schlumberger with a 70% stake in the planned joint venture, with Aker Solutions getting 20% and Subsea 7 10%, the companies said in a joint statement.

The combined business will have approximately 9.000 employees worldwide, and the estimated synergy potential is more than $100 million per year in the medium term, they add.

The transaction is subject to regulatory approvals and other customary closing conditions and is expected to close in the second half of 2023.

More information about the proposed transaction is available on Schlumberger's investor relations website, which can be accessed IN THIS LINK.

Congratulations, only God can pay what…

What is the source of this? Voices in the head…

Thanks for the observation!

Great opportunities!

The names of some chemical elements are…

What did your Genocide do in 4 years…

A comment on niobium, the first…

I have known CBMM for several decades, I belong to…