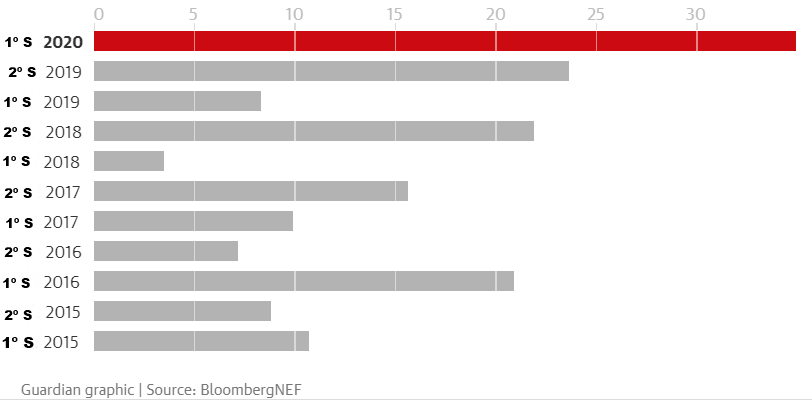

Investors give green light to $35 billion in wind power projects worldwide in first half of 2020

Investment in global offshore wind more than quadrupled in the first half of the year, even as the coronavirus pandemic delivered an unprecedented economic shock.

A report found that investors have given the green light to 28 new offshore wind farms worth a total of $35 billion this year, four times more than in the first half of 2019 and well above last year's total.

The higher half-yearly count of offshore wind energy investment more than offset the slowdown in investment in onshore wind and solar energy projects following the Covid-19 outbreak, according to the Bloomberg NEF (BNEF) report.

Albert Cheung, head of analysis at BNEF, said: “We expected Covid-19 to affect investment in renewable energy in the first half, via delays in the financing process and in some auction programs. There are signs of this in both solar and onshore wind, but the global figure has proved incredibly resilient – thanks to offshore wind. ”

Offshore wind farms include some of the largest investments ever made in offshore wind energy. Hollandse Kust Zuid's headquarters off the coast of the Netherlands will cost Swedish energy giant Vattenfall $3,9 billion, and SSE's Seagreen project in Scotland's Firth of Forth is valued at $3,8 billion.

The number of offshore wind projects given the go-ahead in China rose to 17 in the first half of the year, led by Guangdong Yudean Group's $1,8 billion plans to build the Yangjiang Yangxi Shapaat wind power project.

BNEF believes that offshore wind projects are taking off despite the global economic gloom, due in part to a two-thirds drop in cost since 2012 and a rush in China to finance and build offshore wind projects before the government's subsidy regime expire at the end of 2021.

The growth in offshore wind generated a 5% jump in total renewable energy investment to $132,4 billion, despite the decline in onshore wind and solar projects. Onshore wind investment in the first half of the year fell by a fifth to $37,5 billion, while investment in solar energy was down 12% to $54,7 billion.

China remained the world's largest market for renewable energy, with total investment of US$41,6 billion in the first half of the year, up more than 40% from the same period last year, thanks to its offshore wind boom. .

In Europe, renewable energy investment reached $36,5 billion, up 50%, while UK renewable energy investment rose to $5,7 billion, three and a half times higher than total investment in the beginning of 2019.

Renewable energy investment fell 30% in the U.S. to $17,8 billion, while India and Brazil saw investments that were about 50% and 25% lower, respectively, at $2,7 billion and $2,5. XNUMX billion.