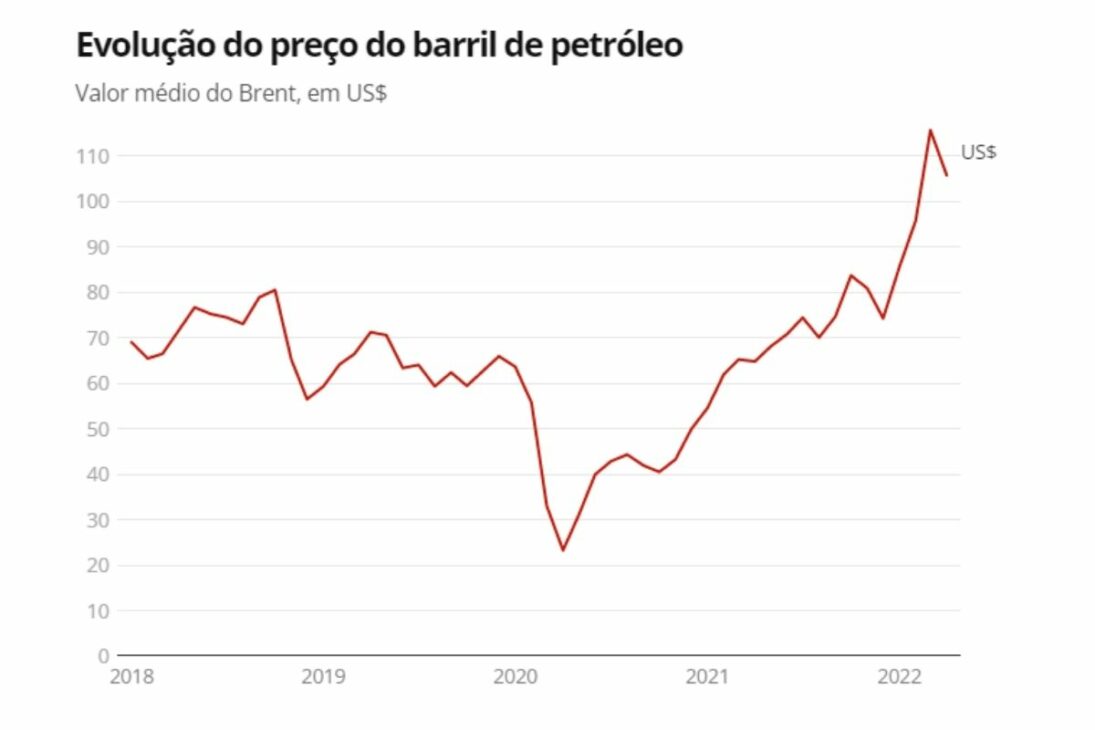

The rise in the price of a barrel of oil is already the highest in the last 2 months and new sanctions on Russia and the end of restrictions in China may be responsible

Last Monday, May 30, 2022, the international price of a barrel of Brent oil hit more than US$ 120. The value is considered the highest in the last 2 months and one of the highest in the last 4 years. Experts point out that this could be a result of new sanctions imposed on Russia due to the war against Ukraine and the end of restrictions on the coronavirus in Shanghai, China. This rise could put pressure on Petrobras to raise fuel prices in Brazil and increase tensions.

The scenario still has predictions to get worse, according to experts, as new sanctions may happen to Russia and the oil consumption by China could increase significantly after the lifting of restrictions in Shanghai because of the coronavirus.

Learn more about this rise in the price of a barrel of oil with the video below

The price of a barrel of Brent oil has been growing monthly and now reaches one of the highest values in 4 years

Some types of oil are known in the world, according to their origin and characteristics. For example, Dubai Crude is a heavier type of oil produced in the Middle East. However, one of the most widespread types today is the Brent, produced in the sea of northern Europe and Asia and with lighter characteristics.

It is estimated that the price of oil for July will reach US$ 121,67 a barrel and the August contract also tends to be higher compared to last year, with the price forecast set at US$ 116,84 at the high of the day.

However, what has been seen so far is the constant increase in the barrel of oil. In 2020 there was a significant drop in value, which may have been due to the lockdown and measures to restrict the movement of people due to the coronavirus, which reduced oil consumption.

However, with the recovery of the economy in the following years, fuel consumption began to increase gradually, and now the price of a barrel was the highest in the last 4 years, as shown in the graph below.

The European Union is due to meet in the coming days to organize a new package of sanctions against Russia

The famous saying "nothing is so bad that it can't get worse" has never made more sense than it does now. Members of the European Union will meet early next week to discuss a new package of sanctions against Russia. This happens due to the lack of agreement between the country and Ukraine for a ceasefire in favor of civilian lives.

Therefore, the marketing of Russian oil will become even more difficult, which may further increase the value of the barrel. In addition, the easing of the movement of people in Shanghai, China, will contribute to an increase in local oil consumption, which may also increase the value.

Petrobras may be pressured by the rise in the price of a barrel of oil worldwide

Brent oil is essential and is considered a benchmark for Petrobras in Brazil. This increase may have an impact on need to readjust fuel for the coming months. This adds to a possible shortage of diesel, which will put great pressure on the state-owned company and could weigh heavily on consumers' pockets. However, for now there is no announcement of new scheduled readjustments.