The lower supply of raw materials and high global demand will push up oil, uranium, copper and aluminum prices

The green economy is already a reality, and countries around the world are trying to reduce environmental risks and ecological scarcities, aiming at sustainable development without degrading the environment. However, as paradoxical as it may seem, this “green economy” should boost the price of several commodities, such as oil, uranium, copper and aluminum, says Ruy Alves, manager of Kinea Asset.

Read also

- Titanic comes to life in China; the luxury ship labeled 'unsinkable' is under construction and will be the size of the original

- Brazil's largest oil company has blocked accounts in Bolivia due to dispute over gas field area

- Macaé will 'get on track'! One of the largest engineering, services and infrastructure companies in the world wants to build a locomotive factory in the city

- Epson invites students from all disciplines for jobs in São Paulo in manufacturing, operations, marketing, human resources and more

The green economy is closely related to the ecological economy, but has a more politically applied focus. This was the keynote of Coffee & Stocks held yesterday (28/05) with Ruy Alves, Kinea's global macro manager (see the full chat in the video below).

The matter is far from trivial, with Kinea even publishing a 9-page letter this week explaining how raw materials such as oil, uranium, aluminum and copper could see their prices rise.

The reason is not the same for all raw materials, but if it were to be summed up in one sentence, we could say that supply should not grow (either because nobody wants to invest in new projects or for environmental reasons) and demand will remain firm or even growing, even for those commodities that are not very friendly in terms of the environment.

See, below, the effects of a green economy on the prices of oil, copper, aluminum and uranium, among others, according to Ruy Alves, manager of Kinea Asset

Going to 2005, during the George W. Bush administration, the United States started its version of the field of dreams: a new renewable energy project, with the use of ethanol extracted from corn to be mixed in gasoline, thus generating a renewable energy source that is neutral in the emission of carbon in the atmosphere.

The effect of the decision was the subsequent increase in the price of corn from ¢200/bushel, in 2005, to ¢800/bushel, in 2011. This effect not only affected the price of corn: the grain competes for area with several other crops, mainly soybeans. The process led to a generalized increase in agricultural prices, subsequently also affecting the price of beef, since cattle not only compete for pasture space with corn, but also feed on it.

We can say that, currently, the world is carrying out a process similar to that of the United States in 2005, but now on multiple fronts and on a global scale. “Our desire to reduce carbon emissions, pollution and move towards an ESG economy (the acronym stands for changing the social impacts of companies) is noble in its intent, but it must also take its toll, which will be reflected in various commodities over the next few years.”

These effects range from the greater demand for “green” applications, as is the case of copper in electrification, also passing through the reduction in the supply of other commodities due to environmental issues, as is the case of aluminum, and reaching potential problems in the supply of other commodities, as we are discouraging investments, as is the case of oil.

Copper – strong green demand with limited supply capacity

The transition to a renewable energy matrix is not limited to energy generation, but also includes its transmission and storage. It turns out that, for the transmission of energy, no metal is more efficient than copper.

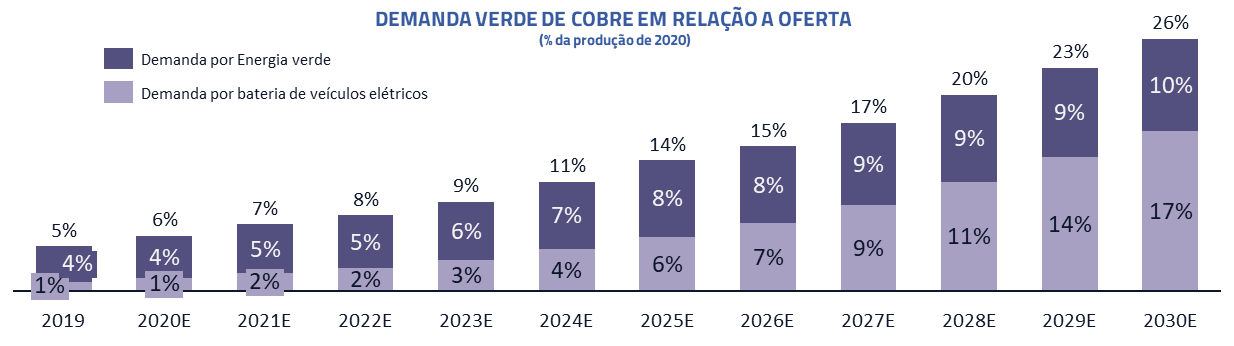

If we are going to transform our energy matrix from fossil fuels to renewables, the entire transmission grid will have to be rethought. The planned wind and solar energy farms need a distribution grid and electric cars demand a huge amount of the metal compared to traditional vehicles.

In addition to the growth in demand, we must also experience a challenging environment for supply. Copper is a rare metal and investments in extraction in recent years have fallen short of what is needed to meet the growth in demand. Important regions, such as Chile and Peru, are currently discussing taxes that may discourage future investments, and new exploration areas are found in regions with greater political instability, such as Africa.

New exploration investments, if started today, should take at least five years to generate substantial supply, and, by the looks of it, there is no prospect of supply meeting the “green” demand for energy distribution and electric cars. This imbalance will likely have to be addressed through higher prices.

Aluminum – environmental issues restricting supply

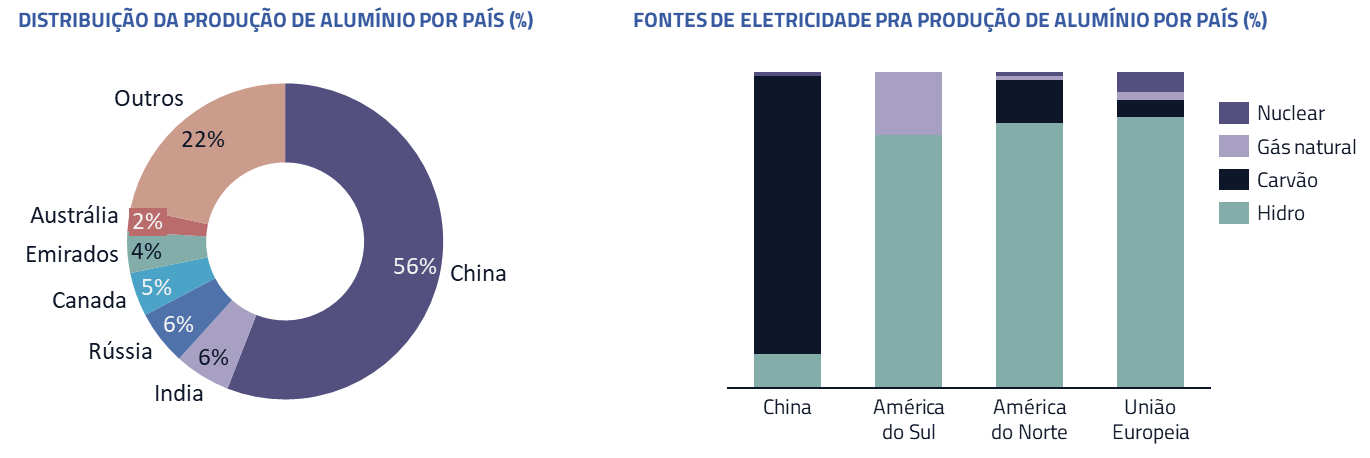

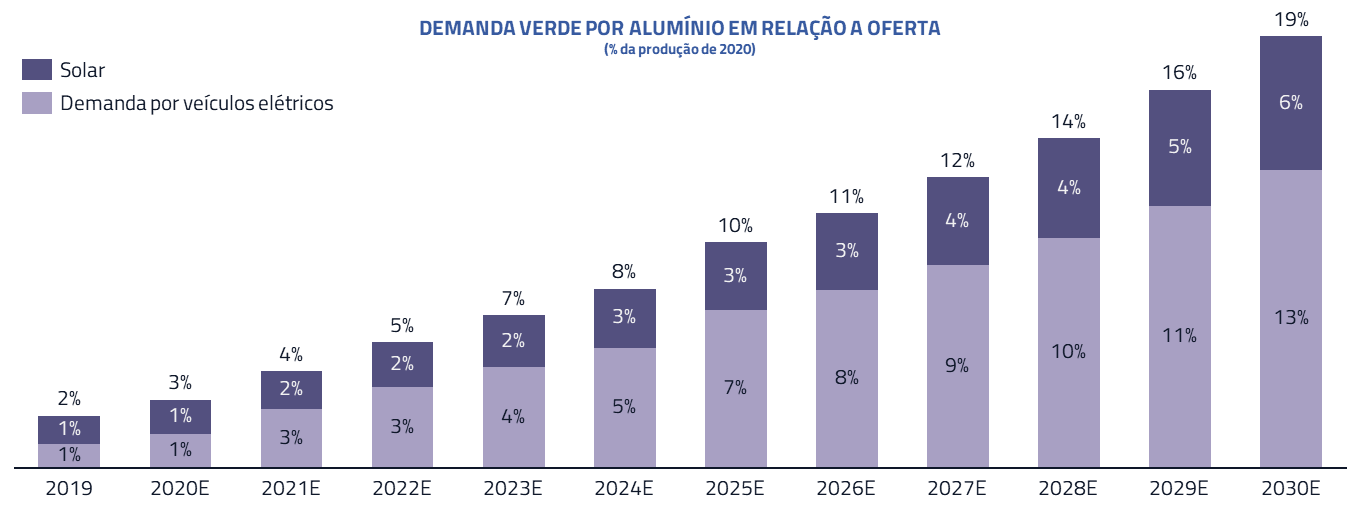

According to Ruy Alves, aluminum reflects a problem that is different from copper: its production demands a huge amount of electricity. Aluminum is produced using bauxite as a raw material, one of the most abundant metals in the Earth's crust. However, due to the amount of energy demanded, the metal can be considered as “condensed electricity”. Its production, in the West, is carried out in regions with an abundance of cheap energy supply: for example, in the cases of Brazil and Norway, two of the main producers, this production is located close to hydroelectric plants.

The problem for the metal is that the main producer, China, responsible for more than half of global production, is a country whose energy matrix is based on coal, the source of the greatest carbon emissions in the atmosphere.

In recent years, China has revised its stance on emissions and pollution, trying to reverse a drastic situation of very high levels of pollution in various regions of the country. Anyone who has been to China must have observed the “fog” constant pollution, combined with the coal trucks that travel to feed energy production.

The consequence of this new posture has been a plateau in global production, which had been growing strongly until 2017. Looking ahead, we must face strong demand from the economic reopening together with the inability of the world to respond with corresponding supply, generating a deficit and consequent drop in inventories, which are already at a level below the historical average.

The metal should also have its demand heated up by the green economy, replacing steel in transport and construction as it is lighter, in addition to its use in solar panels. The combination of a more limited supply and heated demand for the coming years should also be resolved, through higher prices for the metal.

Oil – the risk of neglecting the energy that sustains our society

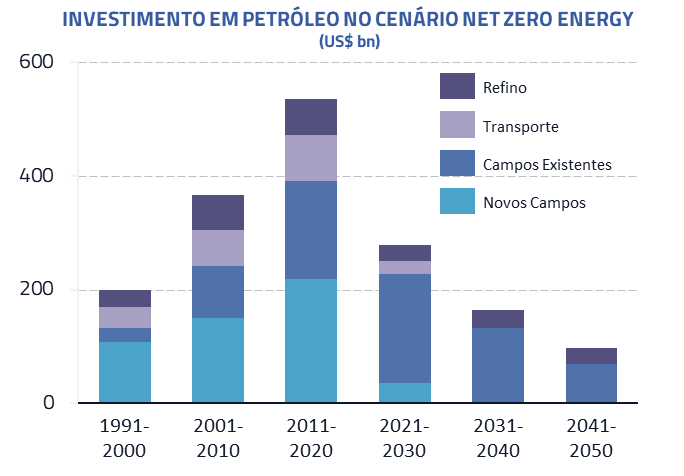

Oil has been the main villain of carbon emissions within the context of global warming over the last few decades. Not a day goes by without global leaders appearing in the press, presenting a negative view of the commodity. Investment funds activated today discourage investments in the sector and the international oil agency itself even suggested that investments in the sector would have to cease to meet the defined targets for carbon emissions.

However, oil is very important for humanity. More than 70% of the energy that powers the United States, the world's largest economy, comes from fossil sources.

The use of fossil fuels, with their enormous energy density, meant that we could spend only 3% of global GDP on energy generation, being able to enjoy the benefits of this energy for the remaining 97% of GDP. The amount of energy we generate is equivalent to every person on the planet having 70 people working 365 days a year for them.

In practice, the decision to migrate from oil should make us spend more of the global GDP on energy generation, and less on the benefits of this generation. A 10x EROEI, for example, would make the percentage of global GDP attributed to energy generation go from 3% to 10%. In other words, we will probably have to pay more for the energy we consume. An effect similar to what happened with the price of corn, mentioned above.

In the last decade, we have experienced a benign environment for the price of oil, due to the entry of shale oil production in the United States, which has become, over the last few years, about 10% of the total production on the planet. However, for the next few years, we should see a different scenario: shale companies in the United States have experienced financial problems in recent years, and the current Biden administration is actively discouraging investments in the sector (limiting access to federal lands and canceling important pipelines). The result is that production is already in decline and the number of new rigs is at a suboptimal level to ensure future production growth.

This comes at a time when inventories are starting to normalize after the pandemic and demand is starting to show signs of recovery. With marginal supply now concentrated in the hands of OPEC+, we could see substantially higher prices in the coming years.

Uranium – the only scalable source of carbon-free electricity base

Renewable energies, such as wind and solar, suffer from a serious problem: intermittency. We cannot expect wind or sunny days to be constant. As battery technology does not allow us to store electrical energy for future use, we need clean sources of energy that can be used as baseload electricity. There are two possible clean sources for this role: hydroelectric and nuclear.

It so happens that hydroelectric energy also presents serious environmental problems. One of them is how practically all the most obvious areas of the planet have already been explored for the generation of this type of energy, new areas, when existing, imply the creation of huge reservoirs that have profound environmental implications. In this context, nuclear energy presents itself as the only scalable alternative for the generation of base and carbon-free energy.

Several countries are already moving in the direction of expanding their nuclear power generation capacity. China, with its energy matrix heavily concentrated in coal, embarked on a project to build new plants. In the United States, Joe Biden's administration is also studying the resumption of nuclear power plant construction projects to achieve carbon emission goals. In Europe, several plants that were scheduled to be deactivated are being kept in operation due to the infeasibility of maintaining the objectives of reducing carbon emissions with other energy sources.

The consequence of this process should be a significant increase in demand for uranium over the next decade. Demand growth will find, on the other hand, a subpar supply function: over the last decade, mainly after the tsunami that affected Fukushima in Japan, uranium production has been reduced substantially. We are already seeing a drop in inventories and the projections for the coming years are for a substantial deficit, which should lead to an increase in prices.

Kinea underscores the commitment to forming a society that is responsible from an environmental point of view and defends initiatives for a cleaner world, with less carbon and with better corporate governance practices.

However, the point that Kinea raises in his article is that there are costs that society and investors should be aware of during this transition period. The green economy will demand resources in areas that today we are not able to supply. This will lead to movements in commodity prices that may become relevant and as investors we must be aware.

per- Kinea