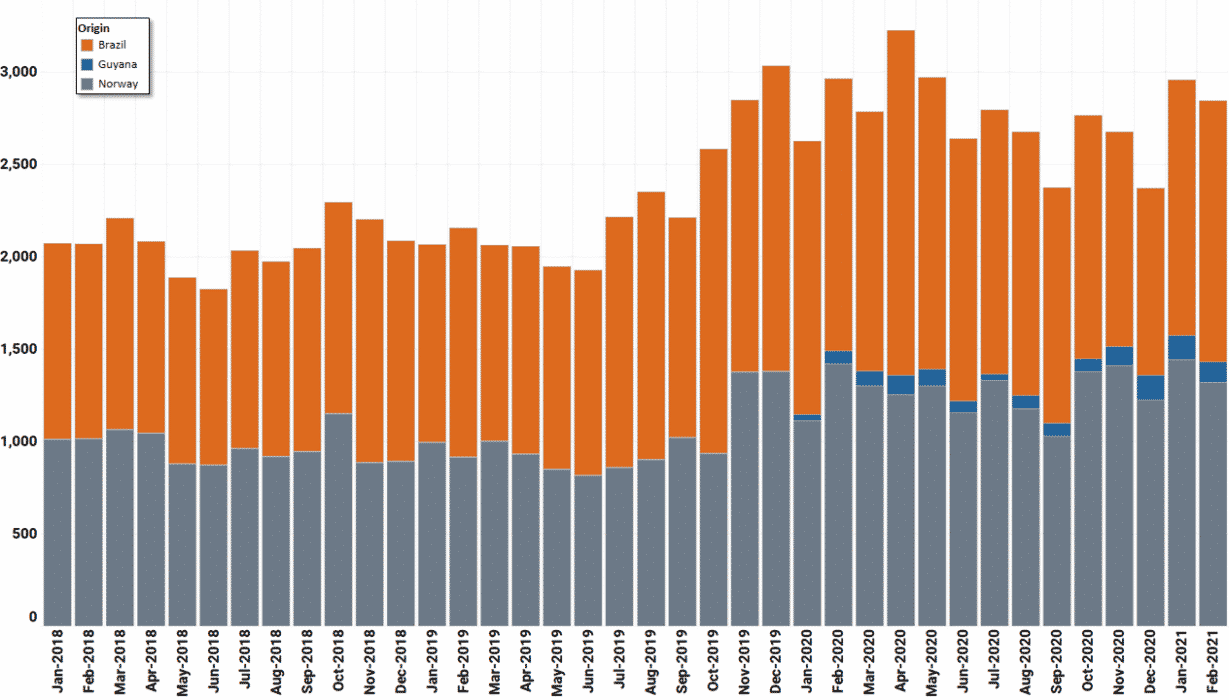

In 2020, Guyana, Brazil and Norway were expected to deliver the bulk of non-OPEC and non-shale production growth, but as Covid-19 hit Brazil hard and some technical issues disrupted Guyana's oil production and from Norway, these countries delivered much less than expected.

This supply growth gap should be partially filled in 2021, as highlighted in the first two months of the year. However, February was a little lower than expected, again due to some gas compression issues in Guyana.

Guyana again suffering from gas compression seal

Guyana's exports reached 102 kbd in February , less than expected and 10% below the previous month, due to a natural gas compression seal that already affected production last year . According to ExxonMobil, the problem occurred again in early February and the repair could take nearly two months. The full-year target is to reach 109 kbd according to the Ministry of Finance, slightly less than initial expectations (Liza Phase 1 can produce 120 kbd).

As a reminder, ExxonMobil started producing 32,1° API Liza crude in late 2019 and forecast production of 750 kbd by 2026 with two projects, Liza phase 2 and Payara, which are expected to come online in approximately early 2022 and 2024, respectively with 22 kbd each. In February, more than half of Guyanese exports went to Panama (75 kbd), while Malaysia, for the first time, imported 37 kbd.

Brazil: higher oil exports despite less from Tupi and Búzios fields

In Brazil, maritime oil exports in February reached 1,38 mbd, high of 4 months after a December record low of 1 mbd. Compared to January 2021, exports increased by 17 kbd, but are still far from the April 2020 record of 1,87 mbd. By degree, Tupi (former Lula) is the main one with 438 kbd, followed by Búzios (255 kbd) and Sapinhoa (206 kbd) which almost doubled compared to January. China was still the main buyer with 593 kbd, but much less than in January, when it imported 950 kbd. On the other hand, and to a lesser extent, the United States and India imported more Brazilian oil: 126 kbd and 90 kbd.

With the increase in exports, former president of Brazil Lula da Silva was released by decision of the Judiciary and highlighted his opposition to any privatization , saying “We did not discover the pre-salt to export oil”. The preliminary ruling accelerated his chance of winning elections in late 2022.

In addition, in February, Petrobras signed a letter of intent with Dutch FPSO supplier SBM Offshore for the delivery of an FPSO to be deployed in the Búzios field, which will be the largest oil producing unit operating offshore in Brazil, with capacity of 225 kbd. Delivery is scheduled for the second half of 2024.

Norway: less oil shipped to China

In Norway, higher exports are driven by the Johan Sverdrup field, which produced more than 462 kbd, as exports to the whole country reached 1,57 mbd, slightly below the 1,72 mbd recorded in January . Norwegian oil was shipped mostly to China (286 kbd) , Sweden (259 kbd) and the Netherlands (238 kbd). In recent months, China has bought much more oil from Norway, at almost 400 kbd on average.

Norway may continue to increase its production capacity in the coming years, as Equinor recently made an oil discovery estimated at 31-50 million barrels near its Johan Castberg complex in the Barents Sea.

Daily maritime exports of oil from Brazil, Guyana and Norway

Volumes smoothed by the 14-day moving average

Source: Kepler