Interest expenses end up being lower than electricity expenses, which keep rising. In addition, it ends with discharge.

The surge in electricity rates has made Brazilians look for alternatives and investing in solar energy has been one of them. When the consumer does not have all the necessary resources, the financing option is advantageous. After all, even with the interest rates that affect the financed amount, in the end, the result is money savings: expenses with the light bill and its continuous increases are cut.

Read also

- 91,3 thousand tons of nickel, a fundamental raw material used in the production of batteries for electric vehicles, produced in Bahia, were exported to China by the only producer of the ore in Brazil, Atlantic Nickel

- Iron flow batteries can remain active for 25 years or more without suffering degradation over their lifetime and will revolutionize energy storage in the world

- Rede Globo opens a selection process for job openings in various areas of secondary, technical and higher education in RJ, SP, Recife and more

- Stop refueling with ethanol now, fuel is no longer advantageous in Brazil, even with Petrobras' new readjustment in the price of gasoline

This year alone, the electricity bill should be 12% more expensive, on average. The conventional tariff has already been readjusted by 7% and, the red flag (value for each 100 kWh), by 52%, according to the National Electric Energy Agency (Aneel). For 2022, the estimate is for an average increase of 16,68%.

They are percentages above the basic interest rate of the economy, the Selic, currently at 6,25% per year. The fee marks the amount of the credit, which is added by other costs, and the total varies from institution to institution. But, in addition to staying within the average increase in the electricity bill, the interest cost ends after the financing is paid off; the readjustments of energy do not cease.

Who makes the comparison is the director of Entec Solar, technology developer for photovoltaic energy generation, Tiago Sarneski. “In practice, it is not a real interest rate, as the rate [paid on financing] replaces the increase in the rate that consumers no longer pay when investing in their own energy generation”, points out the expert.

More than half (54%) of investments in installing panels and generating solar energy in Brazil are financed

In addition, once the loan is paid off, this expense (with interest) is eliminated. According to Tiago Sarneski, investments in photovoltaic energy generation offered on the market by Entec Solar can be paid in up to 96 months. On average, sales are made for payment within five years. “In other words, after that period, the consumer no longer has the readjustments of the light bill, nor the interest on the financing”, he reiterates.

More than half (54%) of investments in installing panels and generating solar energy in Brazil are financed, according to the “Strategic Study – Distributed Generation: Photovoltaic Market”, by Greener, an advisory company in the area. It is a mechanism widely used by micro and small consumers – a group that accounts for almost three quarters (74%) of financing.

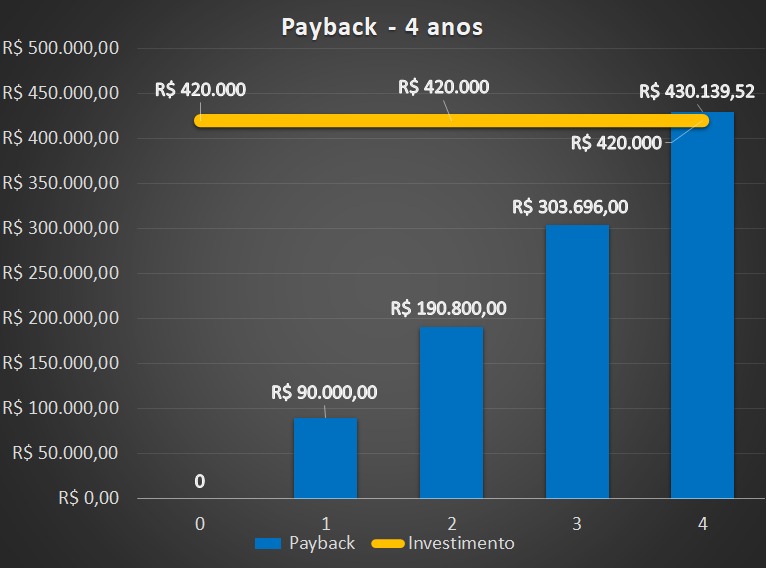

Another fact that makes the investment worthwhile is the so-called “payback”, that is, time for the resources initially spent to be compensated. Entec Solar's manager exemplifies citing an average investment of R$ 420 thousand. Year after year, with the cut in electricity bill expenses, this amount is amortized. Until, in the fourth year, with the savings achieved, the resources invested are recovered.

Graph shows payback – recovery of investment in solar energy

“Both for residential and commercial establishments, it is indeed a considerable investment. However, with the possibilities of financing, with the 'payback', and even more so in this context of water crisis that has increased the cost of energy in Brazil, it is an investment with a financial return, not to mention the importance of environmental sustainability", observes the director of Entec soler.